If freelancers are formally self-employed, but are treated as employees by their client, this is false self-employment in Germany. It is associated with serious consequences, especially for the client side. We provide more general information in this article. Many companies would like to have a checklist with clear criteria for false self-employment in order to be able to prevent it. We provide an overview here.

When does false self-employment begin?

In many cases, false self-employment is not intended by either party and is often not even noticed for a long time. Rather, it results from the circumstances when a freelancer gradually takes on more and more tasks for a company. What began as a simple consulting assignment, for example, can become an engagement equivalent to that of an employee by taking on further activities. The freelancer becomes more and more integrated into the company, receives an internal e-mail address, works regularly in the office, and coordinates vacations with the team.

In the event of an audit, the freelancer can be classified as a false self-employed, even if the client was not aware of this. Ignorance does not protect against the consequences, which can extend to imprisonment. More on the consequences can be found in our article "False self-employment: Potential consequences for clients".

In order to recognize false self-employment in good time or - even better - to be able to prevent it, it is important to know the criteria for false self-employment. In an audit, the individual case is considered. It therefore depends on the combination of indicators that suggest that the freelancer is in dependent employment. That means there is no conclusive official checklist for false self-employment. Nevertheless, some indicators can be defined that help companies stay on the safe side.

Criteria for false self-employment in 2023

The following points are indicative of false self-employment if they are identified for a freelancer:

- Being bound by instructions: They cannot provide their services freely, but must adhere precisely to instructions. (Briefings or agreed deadlines, however, are not problematic).

- Integration into the company: They are integrated into internal processes and a difference between them and the employees is hardly noticeable.

- Dependence: The freelancer is economically permanently dependent on the client. Perhaps they even receive a fixed monthly payment regardless of the specific services.

- No entrepreneurial risk: The freelancer does not act as an entrepreneur (with their own website, free pricing, etc.).

- Restrictions in the contract: The freelancer is restricted by the contract and may not, for example, work for other clients in parallel or must coordinate their vacation.

In our checklist for false self-employment in the next paragraph, we show what these criteria mean in practice.

By the way: If a freelancer only works for one client, there is not automatically a case of false self-employment. This is a common misconception. Although working for only one company can be a first indication, the additional factors such as being bound by instructions and integration into the company are decisive. It may well happen that a freelancer can only work for one client for a certain period of time due to a large project without false self-employment. However, this situation should not extend over many years.

Recognizing false self-employment: Checklist for 2023

Based on the criteria for false self-employment mentioned above, a checklist can be created. It contains common characteristics that indicate that a freelancer is false self-employed. If a company answers many of the questions with "yes", there is a risk of false self-employment. On the other hand, the more questions it answers with "no", the lower the risk.- Is the freelancer given instructions that go beyond a necessary coordination?

- Does the client set the working hours for them?

- Does the freelancer use the company's equipment (laptop, cell phone, etc.) and not their own equipment?

- Do they regularly work in the company's office?

- Do they have their own means of access such as keys or cards?

- Do they wear work clothes of the company?

- Was the contract concluded with a sole proprietor and not with a corporation (GmbH, UG, etc.)?

- Does the freelancer perform the same tasks as employees of the company?

- Do they permanently belong to a team that consists only of employees except for them?

- Do they have to announce vacations in advance and have them approved?

- Do they have to sign off in case of illness?

- Do they receive a fixed monthly salary instead of billing for their services?

- Do they get paid even if they are sick or on vacation?

- Is the freelancer's contract so extensive that they cannot accept any other projects?

- Are they not allowed to accept further projects, or do they have to obtain permission to do so first?

- Do they work on an open-ended basis and not on a project-by-project basis?

- Do they have business cards of the company?

- Do they use a company email address without reference to their external status?

- Are they part of regular meetings that have nothing to do with their tasks?

- Do they receive perks intended for employees (for example, memberships, meal vouchers...)?

In our e-learning, we summarize the criteria clearly once more (in German):

Securely working with freelancers

If you know the criteria for false self-employment well, you have already taken the first step towards working with freelancers in a legally secure manner in Germany. An important principle for this is that freelancers should not be treated like employees.

It is advisable to raise awareness of the issue right at the beginning of the collaboration. This applies both to the internal team and to the freelancer. Especially newcomers who have previously worked as employees easily fall into false self-employment.

In our article “Avoiding False Self-Employment When Working With Freelancers: 4 Tips”, we give more advice for this.

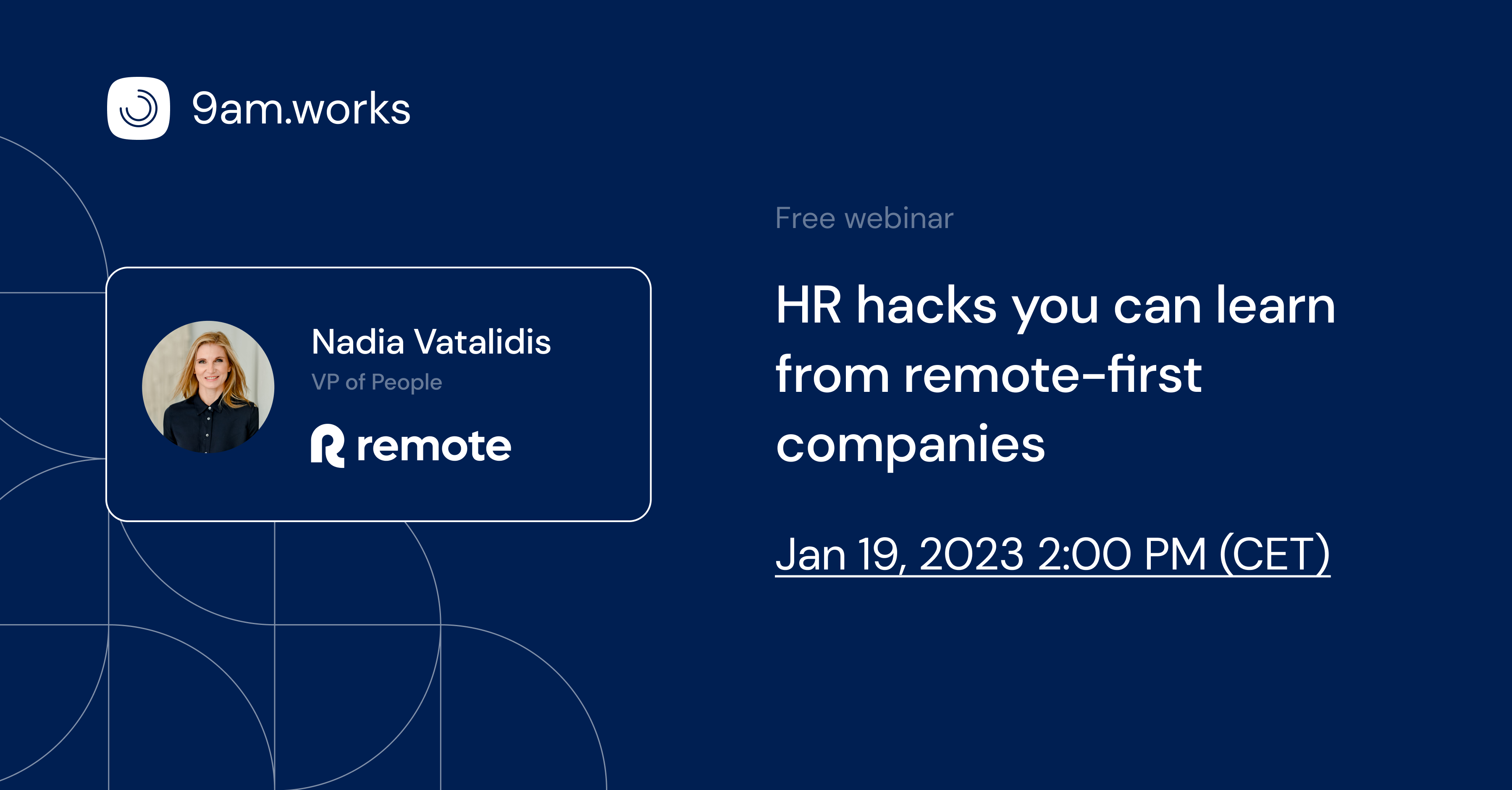

Good to know: With the 9am Compliance Hub, companies receive comprehensive support to avoid false self-employment, for example with a false self-employment check, an e-learning on the topic and compliant contract templates for hiring freelancers. Learn more about the Compliance Hub.