False self-employment (also known as pseudo self-employment) can become an issue when companies work with freelancers in Germany. It means that a freelancer is hired by a company as a self-employed person, but is then treated like an employee during the collaboration. False self-employment comes with very unpleasant consequences for clients: they have to make substantial additional payments for taxes and social security contributions, and they may even face penalties. The German term is Scheinselbstständigkeit.

Why is false self-employment an issue?

Freelancers and fixed employees have a different status that comes with different rights and duties. For example, employees pay into the national pension fund together with their employer, they get health insurance through their employer, and they benefit from paid vacation and paid sick leave. On the other hand, they are bound by instructions, and they have to stick to the company’s processes.

Freelancers get paid for just their work, with no right to get paid time off. They have to take care of health insurance and retirement plans on their own. A freelancer has more freedom, but also bears the risk of being an entrepreneur. If freelancers are treated like employees, they don’t benefit from the social security an employee has, but they give the company the services of an employee. For the company, this means that it saves on social security contributions. False self-employment is considered as a form of black labor in Germany.

You can find more information about false self-employment in general in our article “What is False Self-Employment? Definition and Tips”.

Who does investigations for false self-employment?

A common way for false self-employment to be discovered is a regular company audit by the German Pension Insurance (Deutsche Rentenversicherung). But it’s also possible that a client or a freelancer initiates a “Statusfeststellungsverfahren” (“status determination process”), which is also done by the pension insurance. Alternatively, there can be a complaint from a third party that triggers an audit. Or a freelancer tries to sue the company for a permanent position.

Apart from the pension insurance, there are other institutions that could do checks for false self-employment: the tax office, a labor court, a health insurance provider, or the “Finanzkontrolle Schwarzarbeit”, a part of the main customs offices in Germany focused on black labor.

If you want to learn more about how to recognize false self-employment, take a look at our checklist.

What happens if false self-employment is discovered?

There are various consequences in several areas that can occur if a false self-employment is detected. They have to do with social security contributions, taxes, labor law and further legal consequences in case of intentional behavior on the client’s part.

False self-employment can occur unintentionally over time, with neither side realizing what is happening. If a freelancer becomes increasingly involved in the company and takes on more and more tasks, the risk for false self-employment is growing. But it’s important to know that ignorance is no excuse. Clients must make sure to comply with all regulations in Germany.

The following consequences are possible if a false self-employment is detected:

- Social Security Contributions: The client has to pay the contributions for the freelancer for up to for years in arrears. This can be a big sum, and late payment penalties are added on top. If the freelancer becomes an employee, the company can claim a portion of the payments from them, but this is limited to the next three salary pay-outs.

- Payments for taxes: No wage tax has been paid for the freelancer, so there are additional payments for four years in arrears. When it comes to taxes, both sides are jointly liable, which means the client doesn’t have to pay everything. The sales tax charged by the freelancer is no longer valid and there has to be a reversal.

- Labor law: It is possible that the freelancer becomes an employee. They can also go to court to get this status. The employee status enables them to get paid vacation, continued wage payments while they are ill, and they benefit from the German dismissal protection regulations (Kündigungsschutz).

Deliberate intention of the client is punishable

The payments mentioned above can already become a serious problem for the client, especially if they are working with several freelancers and false self-employment is discovered. But it can get even worse.

If a client is accused of acting intentionally (meaning they were aware of the situation and still decided to continue it), the result can be a fine or even a prison sentence. The period for which there are back payments to be made increases to up to 30 years.

In our article “Avoiding False Self-Employment When Working With Freelancers: 4 Tips”, you can learn how to avoid the risk of false self-employment.

Consequences of false self-employment for freelancers

Of course, there are also consequences for the freelancer in question. But they are not always negative. As mentioned above, freelancers can sue the company to get a permanent position there. They can become an employee with all the rights and obligations connected to that.

But they also have to pay wage tax and maybe a part of the social security contributions in arrears for the time they were false self-employed. There is also a reversal of the sales tax they have charged in their invoices, which is a complicated process.

The consequences of false self-employment for freelancers are less severe than the ones for companies. Whether they are at least partly happy about them or not depends on their personal situation and preferences.

In our e-learning, we explain the consequences of false self-employment in a short way (in German):

Who is more strongly affected by the consequences?

As we have seen, the consequences of false self-employment are unpleasant for both sides. But for clients, they are more severe in the economic dimension. The payments can become a financial risk for the company. After all, it is likely that they have worked with several freelancers in the same set-up. If these are audited too, the costs can multiply.

Moreover, there’s also the risk of a fine or a prison sentence in the case of intent. This is something the freelancers don’t have to fear. For companies it is therefore more important to be aware of the consequences of false self-employment and to take steps to prevent them

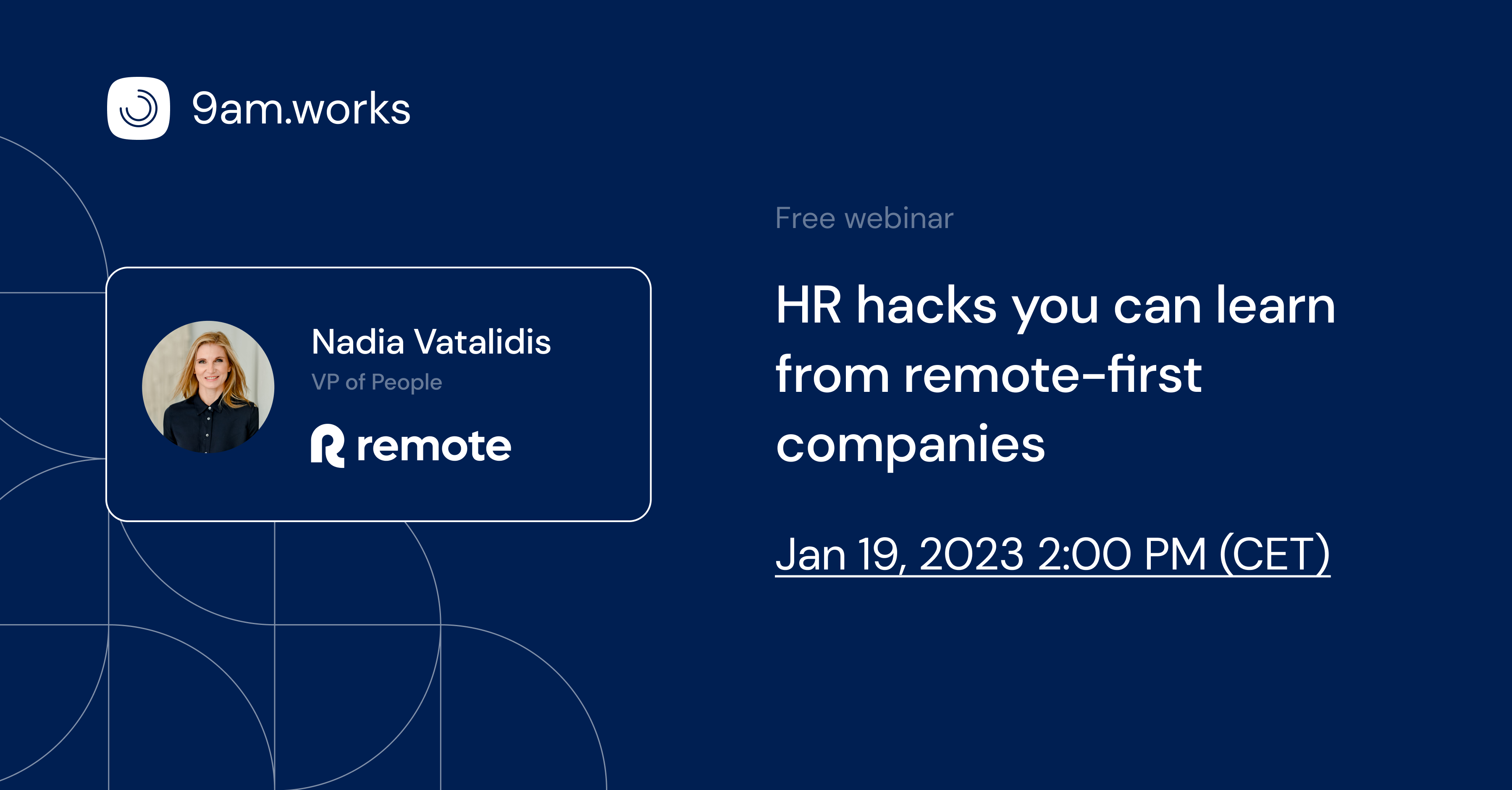

Good to know: With the 9am Compliance Hub, companies receive comprehensive support to avoid false self-employment, for example with a false self-employment check, an e-learning on the topic and compliant contract templates for hiring freelancers. Learn more about the Compliance Hub.